Two recent Survation public opinion polls for the Mail on Sunday have generated contradictory data about public support for “green taxes” and other government policies that add charges to people’s energy bills.

What are these charges on our energy bills?

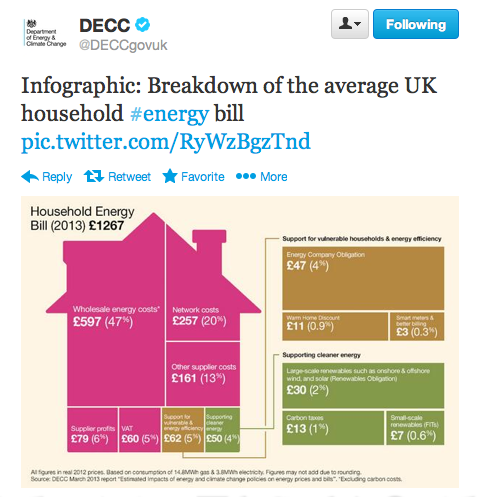

According to the DECC infographic, the energy companies currently add around £112 of charges a year to our energy bills, in order to pay for:

- the Energy Company Obligation (ECO)

- Warm Homes Discount

- Large scale renewables (the Renewables Obligation),

- Carbon taxes

- Small scale renewables (Feed In Tariffs)

This mix of subsidies and carbon taxes provides incentives for renewable energy generation and energy conservation, and pays for the Warm Homes Discount for vulnerable households. Feed In Tariffs and the Energy Company Obligation are subsidies that the energy companies pay in order to encourage – respectively – small scale renewable energy generation and households’ energy conservation.

But the public ends up paying all these subsidies and carbon taxes, because the energy companies pass on the costs by levying charges on energy bills – a socially unfair, or regressive, form of taxation, since evidence shows that it hits the poorest hardest.

One of the carbon taxes is the the European Union Emissions Trading Scheme (EU ETS) – the least popular green tax among respondents to the Survation Energy Issues poll for the Mail on Sunday.

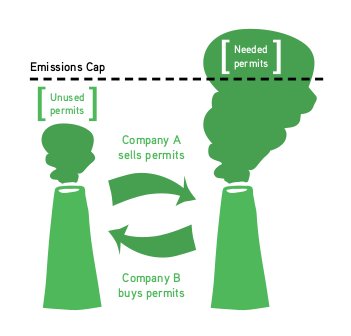

The EU ETS gives EU countries the right to exceed their binding greenhouse gas emissions targets. It functions through two mechanisms. One, ‘cap and trade’ sets a cap on the amount of carbon emissions that energy companies and big carbon polluting industries are allowed to produce, and creates a market for them to buy and sell carbon emissions permits, according to whether they have exceeded or undershot their cap.

So if companies pollute less than they are allowed to, they can sell their excess carbon permits to a company that is polluting more than it’s allowed to. The less polluting company will profit, and the more polluting company will lose money. The theory is that emissions trading will provide incentives for companies to invest in renewable energy generation or energy conservation measures, but this only works if the price of carbon is higher than the cost of investing in renewable energy generation or energy conservation measures.

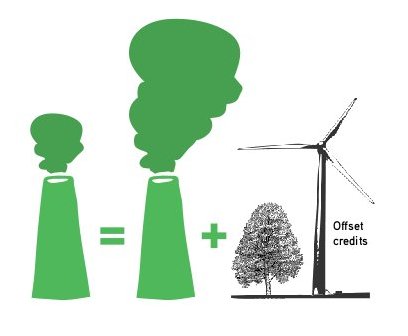

The second EU ETS mechanism is “offsetting”. This allows energy companies and high-carbon polluting industries to buy carbon credits generated from ‘emissions saving’ projects in other countries, mostly in the Global South.

Each carbon permit or credit is for one tonne of carbon dioxide equivalent (CO2e).

Faced with the failure of the EU ETS to price carbon emissions at a level that incentivised renewable energy generation and energy conservation, the Coalition government introduced a new carbon tax on 1 April 2013: the carbon floor price.

Survation public opinion polls for the Mail on Sunday

The first October 2013 Survation poll for the Mail on Sunday showed that nearly 40% of respondents supported “green taxes” on energy bills, the second that 60% opposed them.

So what’s going on?

The “October Issues” Survation poll for the Mail on Sunday asked this open question (Q21):

“Do you support or oppose the existence of ‘green taxes’ to help investment in renewable energy? “

Responses were fairly positive – 39.7% said they supported or strongly supported this, compared to 29.3% who opposed it. The rest were neutral or didn’t know.

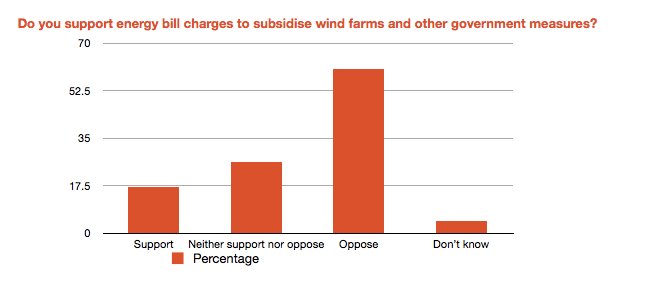

Perhaps this wasn’t what the Mail on Sunday wanted to hear, since Survation then carried out an Energy Issues poll for them, and asked this rather loaded question: (Q11)

“Q11. At the moment the average annual household energy bill includes £128 in “green taxes”, used to subsidise items such as wind farms, and other government measures. By 2020, this figure will be around £270 Do you support or oppose the existence of these charges?“

This question got a very negative answer (only 17.8% supported and 60.3% opposed, with the rest of responses neutral or don’t know.)

Public support for helping less well-off stay warm

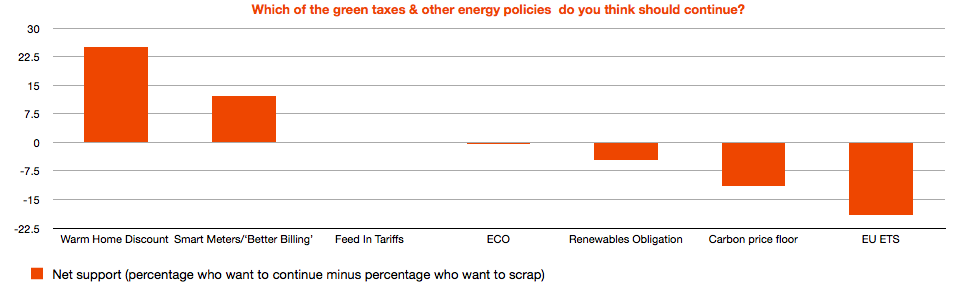

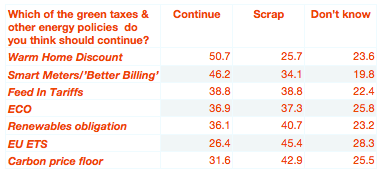

Data from further questions in the Survation Energy Issues poll show that respondents’ support for specific “green taxes” and other charges on energy bills was higher for socially fair “green taxes” and other charges.

For example, in the Survation Energy Issues poll, 50.7% supported the continued existence of the Warm Home Discount. When respondents who wanted it scrapped are taken into account, net support for the Warm Home Discount is 25% of respondents.

Net support for the various green taxes and other charges is shown in the bar chart below.

The net support is calculated like this: Percentage who support the tax/charge, minus percentage who want to scrap it = net support.

An article on the Noise of the Crowd website suggests that this shows that people are basically fair-minded and are prepared to pay for policies that benefit the least well off.

Socially unfair green subsidies

The socially unfair nature of Feed In Tariffs (FITs) and the Energy Company Obligation (ECO) has been clear for some time.

There is also strong evidence that the EU ETS hasn’t worked. According to the Carbon Trade Watch report, Green is the Color of Money (June 2012),

“The EU ETS has failed to achieve its own objectives. It has not reduced greenhouse gas emissions…the history of carbon trading is littered with evidence that companies and governments use the market to pre-empt and delay the structural changes necessary to address climate change.”

So another way of looking at the responses to the Survation Energy Issues poll may be that they show that people are sceptical about paying for policies that aren’t working.

If so, this would suggest that the public wants effective as well as socially fair policies for reducing carbon emissions.

Calderdale Council’s energy policy

Fuel poverty in Calderdale is high. By Calderdale Council’s own reckoning, the Green Deal and Energy Company Obligation subsidies provide far less help with energy saving measures for fuel poor, vulnerable households than previous home energy efficiency funding schemes. The Coalition government cut these in their Comprehensive Spending Review.

The Calderdale Energy Future 2013-14 Action Plan aims to direct ECO subsidies, renewable energy feed-in tariffs and renewable heat subsidies to rural areas off the gas main. This will channel significant subsidies to largely well-off homeowners in extremely energy-inefficient old houses, in remote areas associated with high transport carbon emissions because of residents’ dependence on cars.

These subsidies are socially unfair – they are paid for by all energy users (ECO and FITs) and taxpayers (renewable heat incentive), but they disproportionately benefit the better off – who also create more carbon emissions in the first place.

Joseph Rowntree Foundation research shows that the FIT is highly regressive – it benefits the well-off at the expense of the rest of us. The Joseph Rowntree Foundation 2013 Report on Distribution Of Carbon Emissions In The UK: Implications For Domestic Energy Policy states that,

“12 per cent of households, with an average annual income of £62,389, are expected to benefit from FIT by 2020, by around £360 per year, but this is funded from all household energy bills and non-domestic customers who do not benefit.”

Even those households in fuel poverty pay for the FIT through a charge on electricity bills. The Joseph Rowntree Foundation Report on Climate Change and Social Justice confirms that

”…the Feed In Tariff can be expected to have a regressive distributional impact across UK households.”

This is because the Feed In Tariff takes money from less well off people and gives it to better off people.

This is not to say that there are no advantages to the FIT, even for those who don’t receive any FIT payments. The FIT has:

- stimulated the growth of jobs in wind turbine installation and solar photovoltaic (pv) installation

- brought down the price of solar pv panels and installation, so that they’re more affordable

- increased the amount of renewable energy generation

Imo, it’s hard to argue with green jobs and renewable energy generation. But there have to be better ways of creating them than socially unfair FIT subsidies.

And besides, because of the way FITs interact with the EU emissions trading scheme (ETS), renewable energy generated as a result of the FIT subsidy doesn’t reduce carbon emissions.

Carbon taxes that don’t reduce emissions

As FITs-subsidised renewable energy replaces electricity generated by fossil fuels, the energy companies reduce their carbon emissions. Through the EU ETS, they can then sell their surplus carbon emissions permits to companies in the industry sector who want to go on producing more carbon emissions than they are permitted to make.

Spot the problem? The result is that,

The ineffectiveness of the EU ETS is confirmed in Climate Change Mitigation from Renewable Energy, a chapter by Richard Green in a book called The Economics and Politics of Climate Change. If the EU ETS worked as intended, it would force the price of carbon up and make renewable energy more competitive. But Richard Green writes,

“The EC has estimated that the EU renewables target would reduce the price of carbon in the EU Emissions Trading Scheme by 10 Euros per tonne of CO2. This implies that the renewable energy is used as a substitute for other ways of reducing carbon emissions, rather than tightening the emissions target to take account of the contribution from renewable energy.” (p298, 2011 paperback edition).

By the time the Coalition government was carrying out its consultation on the introduction of the Carbon Price Floor tax, the price of carbon emissions traded on the EU ETS had fallen to beyond-ridiculous low levels. For example, at the end of 2007, the price of a carbon permit was €0.02.

This offered no incentive to companies to reduce their carbon emissions, since they could simply buy more carbon emissions permits for next to nothing.

Coalition government introduced the Carbon Price Floor

In an attempt to fix the broken emissions trading market by driving up the price of tradable carbon emissions, the Coalition Government introduced the Carbon Price Floor tax on 1st April 2013. The Carbon Price Floor taxes fossil fuel energy generation at a rate that makes carbon emissions cost £16/tonne in 2013, rising to £30/tonne in 2020.

If you believed that the broken emissions trading market was worth fixing, it would be possible to drive up the price of carbon emissions by reducing the number of carbon emissions permits that are issued through the EU ETS and tightening emissions reduction targets ( the emissions “cap”).

But the power of the energy lobby over the UK government and the EU Commission and EU Parliament stops this from happening. There is also the neoliberal fixation on the financialisation of everything – any problem about resources of any kind is best solved by creating a financial instrument of some kind or another and then letting the banks trade them.

As with so-called “austerity” policies introduced following the massive failure of the financial sector, the public pays – the energy companies pass on the carbon price floor tax to the public through a charge on our energy bills.

Meanwhile, large industrial companies, energy companies, banks and financial sector businesses have made a financial killing by trading carbon emissions through the EU ETS.

Use the carbon tax revenues to fund nationwide home energy efficiency retrofit programme

Campaigns like the Energy Bill Revolution, backed up by organisations like Consumer Focus, propose a way of returning benefits from the carbon floor price tax to the public, that will reduce carbon emissions by increasing energy conservation.

The Energy Bill Revolution proposal is to use the carbon floor price tax revenues to pay for a nationwide, street-by-street, home energy efficiency retrofit programme. This would also alleviate fuel poverty by making houses easier to heat and reducing energy bills.

Calderdale Councillors agreed that Calderdale Council should sign up to support the Energy Bill Revolution. Despite this decision, the Council has still not got round to signing up as a campaign supporter. If you think they should, please email your Councillor.

Scrap the EU ETS Declaration

Like so many financial instruments, the workings of the EU Emissions Trading Scheme and FITs are hard to understand. This means they are hard to regulate and wide open to abuse by bankers and traders who spend their working lives figuring out how to game the system.

Scores of social, climate and environmental justice organisations have already signed the Scrap the EU Emissions Trading Scheme Declaration and are inviting others to join them.

The Declaration calls for the abolition of the Scheme by 2020, on the grounds that it doesn’t work, and by focussing on carbon price as a mechanism for supposedly reducing carbon emissions has locked us into an economic system that’s dependent on fossil fuels.

The Declaration identifies these key flaws in the EU ETS:

- not only has the scheme not reduced carbon emissions, its poorly-regulated offset projects under the Clean Development Mechanism (CDM) have led to an increase in carbon emissions

- it has worked as a subsidy scheme for carbon polluters

- it has led to volatile and falling carbon prices

- it increases social and economic conflicts in Southern countries where CDM offset projects are set up

- carbon markets are very susceptible to fraud

- public money is squandered on setting up carbon markets that don’t work or serve a public purpose

- it locks in the fossil fuel economy

- it prevents the development of effective climate change policies

If the public won’t support socially unfair green taxes – and they won’t support green taxes and policies that don’t work either – then the interesting question is, what effective and socially fair ways are there of reducing carbon emissions and increasing energy conservation and renewable energy? That the public would really get behind?

Links to info sources

- Here is the Noise of the Crowd article

- Here is the downloadable Consumer Focus response to the Coalition Government consultation on the carbon price floor.

- October Issues Survation poll for Mail on Sunday is downloadable here .

- Survation’s Energy Issues poll for the Mail on Sunday is downloadable here.