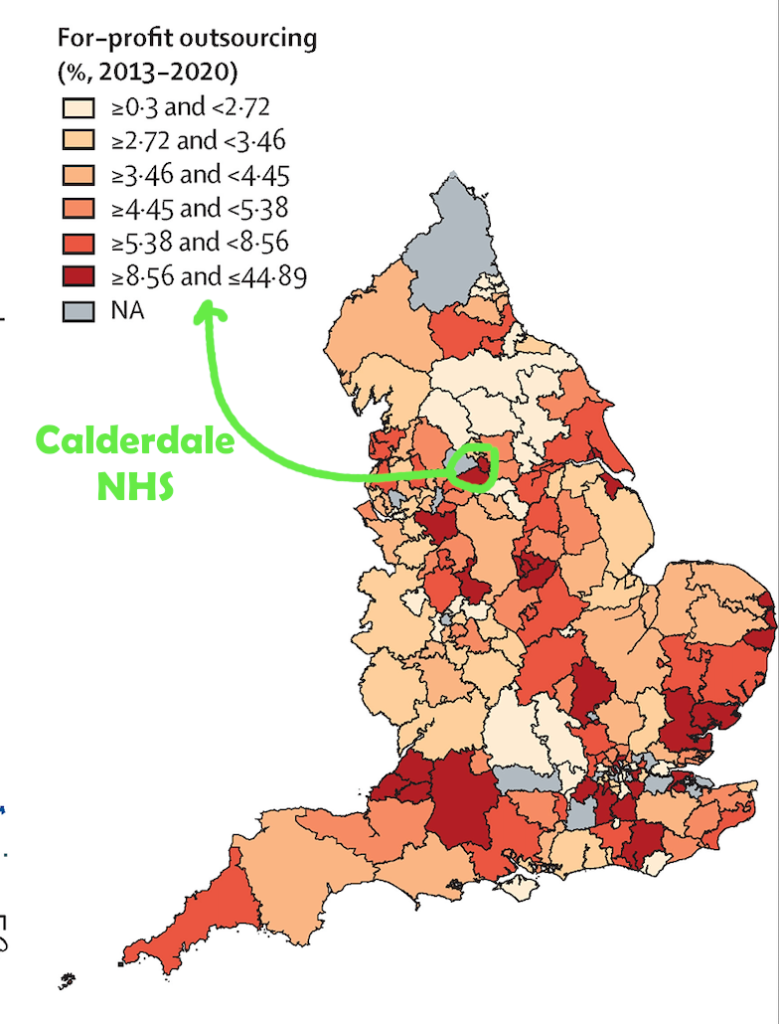

Update 30 January 2025: Calderdale has one of the highest rates of NHS privatisation in England. (See graphic below.) An August 2022 LSE British Politics and Policy blogpost found that in areas with increases in outsourcing there are more deaths of people with treatable conditions.

Four years ago, Craig Whittaker assured me there would be no privatisation of the NHS

In 2013 Calder Valley MP Craig Whittaker assured me that there would be no privatisation of the NHS under this Government. Some of his constituents already knew better. The list of privatised NHS services in Calderdale was already long.

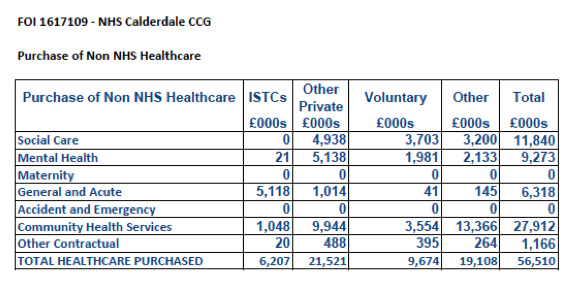

In 2015-16 Calderdale Clinical Commissioning Group spent 13% of its £267,919,000 budget on non-NHS (ie private sector) providers.

This is not counting what it spends on social care, which is mostly privatised, and on voluntary sector organisations, which is “soft” privatisation.

When you count those in, 21% (£56,510,000) of the Clinical Commissioning Group’s budget goes on non-NHS providers.

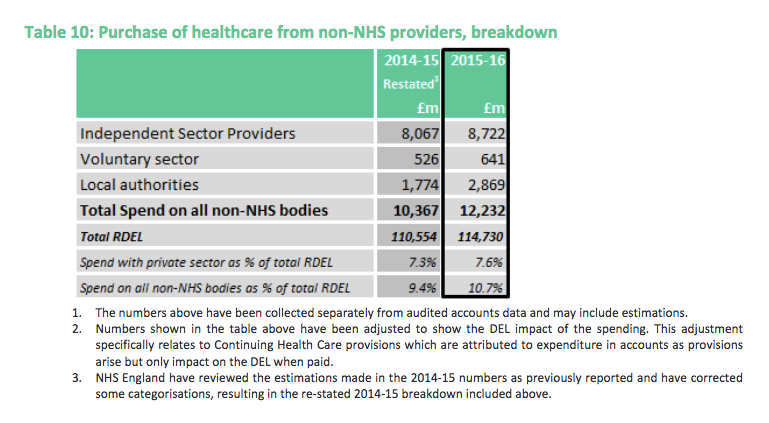

Calderdale CCG’s spending on non_NHS providers is far higher than the national average. The respective national averages are 8% and 11%, as the table below shows.

The high level of NHS privatisation in Calderdale is not surprising given the proclivities of Calderdale Clinical Commissioning Group’s Governing Body Chair, Dr Alan Brooks. On more than one occasion he has said they have no loyalty to existing NHS providers.

Of Calderdale Clinical Commissioning Group’s £56.51m spending on non-NHS healthcare in 2015-16, nearly half (£27.912m) was on Community Health Services. This is the biggest category of non- NHS healthcare. It would be good to know what these Community Health Services are and who provides them.

I shall ask.

The fact that community health services make up the biggest share of non-NHS providers is in line with the national trend that this is biggest area of privatisation. Virgin and Optum are making massive bids for community health contracts; and in all 44 so-called Sustainabilty and Transformation Partnerships that are now being set up, EVERYWHERE is having to cut hospital services and put them in the “community”.

This starts to put flesh on the bones of 999 Call for the NHS’s point that a massive increase in privatisation will result from Sustainability and Transformation Partnerships, as they introduce new pre-set fixed health and social care budgets for an area’s whole population, to be administered by new Accountable Care Systems that will shift hospital care into the “community”.

Moving hospital services in community is thin end of massive NHS privatisation wedge

The Financial Times reports that 47%of NHS spending on community health services now goes on non-NHS providers, including private companies and charities. This includes key activities such as community nursing, health visiting and occupational therapy, adding up to more than £10bn during 2016-17. This is up from 20% in 2010-11 and 31% in 2012-13.

In 2008 the New Labour government encouraged competition between providers to secure community service contracts, regardless of whether providers were NHS, private or voluntary organisations. In Kirklees, this led to the transfer of community services from the NHS to the community interest company Locala, despite resistance from the NHS community services staff. In 2012 the ConDem government adopted an “Any Qualified Provider” approach to community services commissioning.

Speaking at a launch event for the 2016 LaingBuisson Healthcare Market Review, hosted by report sponsor Bilfinger GVA, LaingBuisson Chairman William Laing said:

“ Looking to the future, independent sector operators believe that they have an important role to play in the transformation of UK health and social care from its fragmented, hospital-based present to an integrated, community-based future, which is the consensus goal of policymakers, but while the regulatory changes of recent years mean that they can now compete on a reasonably level playing field with NHS in-house providers, they are being held back because the Conservative government still sees internal reform of the NHS as the more politically acceptable solution to the efficiency challenge for the NHS, rather than strong encouragement of more competition and outsourcing to the independent sector.”

Despite the claim that private health companies are being held back by the Conservative government, LaingBuisson reported that revenues generated by independent sector (non-statutory) providers across 12 core health and care market segments grew by 5% in 2015 to reach £45.3bn as NHS and social care underfunding of both national and local government bodies “is leading to continued outsourcing of publicly funded services.”

The LaingBuisson report shows that value of the private health sector is 39.5% of the value of NHS services. This is up from 28% in 2012.

“The main growth areas were private acute healthcare, up 8% to £7.8bn (driven by recovering private demand as well as NHS ‘choose and book’ patients opting to receive NHS paid treatment in independent hospitals) followed by care homes for older people (driven by privately paying residents) and mental health hospitals (up 4% thanks to strong demand from the NHS as the NHS’s own in-house mental health hospital capacity continues to decline).”

Pingback: Calderdale has one of the highest rates of NHS privatisation in England – NHS MATTERS!

Surprised if they’re beating Dorset on Privatisation. Clinics in NHS HOSPITALS for seeing patients privately. Diabetes eye care etc….