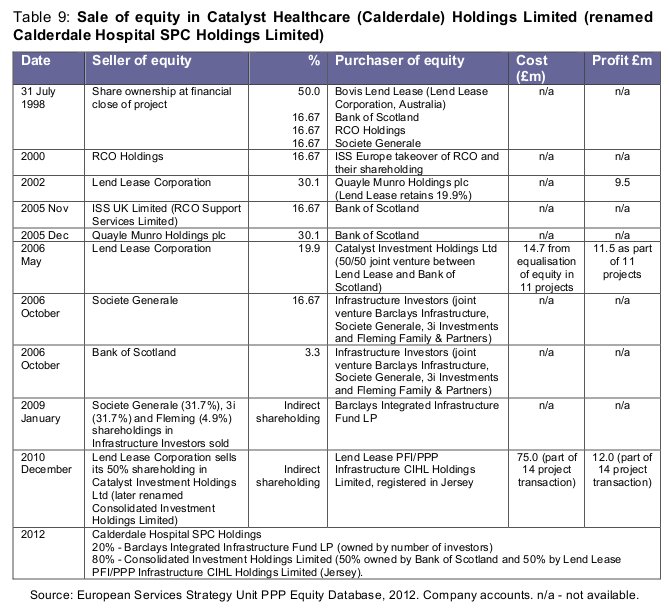

Equity in the Calderdale Royal Hospital (CRH), which is notorious as one of the most costly and least accountable PFI schemes in the NHS, has changed hands 10 times.

According to the House of Commons Public Accounts Committee, PFI equity sales are,

“the unacceptable face of capitalism.”

The 10 CRH equity sales make it hard to know who actually owns the debt that Calderdale and Huddersfield NHS Foundation Trust has still to pay off, or the extent of equity holders’ profits, or what tax the equity holders paid – if any.

But the European Services Strategy Unit has managed to identify the companies involved in the equity sales.

Since 2012, Barclays Integrated Infrastructure Fund (owned by a number of investors) holds 20% of the equity in Calderdale Hospital SPC Holdings Ltd, and Consolidated Investment Holdings Ltd (CIHL) hold 80%.

Of the 80% CIHL holding, 50% is owned by Bank of Scotland and 50% is held by Lend Lease PFI/PPP Infrastructure CIHL Holdings Ltd (Jersey). In other words an offshore company that pays next to no tax.

By some accounting dark arts, Lend Lease PFI/PPP Infrastructure CIHL Holdings Ltd (Jersey) reported earnings results for the year ended December 31, 2011 that showed:

- an operating loss of GBP 9,877,

- profit on ordinary activities before taxation of GBP 39,410 and

- profit for the period of GBP 29,163.

This was the year before the company bought what must have amounted to scores of milllions of £s of equity in the CRH PFI.

Duh?

PFI refinancing and equity sales – “the unacceptable face of capitalism”

In March 2007, the Public Accounts Committee (PAC) reviewed PFI debt refinancing and the PFI equity market.

Refinancing is when the PFI contractor raises cheaper finance to pay off the more expensive initial finance. This reduces the contractor’s overall costs and generates additional profits. The way it works is that initial PFI debt is at a high-ish rate of interest because of the risks associated with a major new build, but when the PFI scheme is up and running, there are fewer risks to the PFI contractor so they can take on debt at a lower rate of interest.

A Note by the House of Commons Scrutiny Unit says,

“The large refinancing gains accruing to some PFI contractors have attracted criticism.”

You bet.

In 2002 the Office of Government Commerce introduced a voluntary code of practice on PFI refinancing. This stated that government departments should generally receive a 30 per cent share of future refinancing gains on existing PFI deals, and that gains from refinancing deals on new projects should in general be shared 50:50.

Like most voluntary codes, it wasn’t worth much. The PAC Twenty-fifth Report of Session 2006-07 found that under the voluntary code, money going to government from refinancing was much less than the Office of Government Commerce had anticipated.

The PAC Report suggested that this government shortfall in refinancing gains was because PFI investors decided they could make more money through selling their shares in the secondary equity markets, rather than having to share their refinancing profits with government.

This is what PFI investors in Calderdale Royal Hospital did.

Unlike debt refinancing, the Treasury does not require investors’ gains on selling equity in PFI projects to be shared with the public sector.

The PAC Report pointed to a lack of expertise in the public sector in negotiating contracts with the private sector, with the result that some locally negotiated refinancing has:

“produced very high investor returns and increased risks for the public sector such as higher termination liabilities and longer contract period”.

The Public Accounts Committee said that gains made by the company, Octagon, from

the refinancing of Norfolk and Norwich Hospital, were:

‘the unacceptable face of capitalism’

A Note by the House of Commons Scrutiny Unit explains that despite the PFI refinancing voluntary code,

“The public sector sometimes still has to take on added risks in order to share in the refinancing gains. For instance Darrent Valley Hospital had to extend its contract and take on the risk of an additional liability if the PFI contract ended early in order to share the PFI refinancing gains with the private contractor.”

This may explain the confusion over whether the CRH PFI contract lasts for 30 years (as in the 2012 Treasury PFI list) or 60 years (as in MP Craig Whittaker’s tweet), and why, according to his tweet, there is a penalty written into the break clause:

“There is a break clause which can be exercised in 2031. Must decant from hospital from 2029 to do so. Cost is £22m”

Last week CHFT agreed to send me information about the CRH PFI contract. Update: It has now arrived.

Here is the 1998 Concession Agreement between Calderdale Healthcare NHS Trust (as was) and Catalyst Healthcare (Calderdale) plc (the Concessionco).