The costs of repaying the PFI debt and of paying for the expensive PFI hospital maintenance and service contracts are one of the causes of the Calderdale and Huddersfield hospital Trust’s finance problems.

PFI costs, funding shortage and Strategic Review of future of NHS and social care

Shortage of funding is behind the proposed closure of Calderdale A&E and at least 100 acute hospital beds, and their replacement by a new system of care in the community that is based on an American private health care system used by a company called Kaiser Permanente.

The downloadable CHFT Annual Report 2012-13 makes no bones about this. Referring to the Health and Social Care Act 2012, which kicked in on 1st April 2013, The Chairman’s statement says that the Trust is preparing for:

“one of the biggest reorganisations ever to affect the NHS…Looking ahead to next year, there is no doubt the financial challenges will deepen as austerity measures impact across public sector services…Really important in this context is the work going on across the health economy to redesign the way health and social care is provided in Calderdale and Kirklees.”

The Directors’ Report makes several more references to shortages of funding and the need to make savings.

Given this pretty dire situation, I thought it would be good to know how much money is sucked straight out of CHFT into the coffers of the banks and equity companies that hold the PFI debt.

According to a 2012 Treasury PFI Spreadsheet, paying off the PFI debt means that CHFT has to cough up repayments that will cost around £773m and only be paid off in 2031/32. The repayments are called a Unitary Charge. This is made up of “mortgage” payments on the building – although it’s not really a mortgage because at the end of the contract ownership will not transfer to CHFT – and service charges for various aspects of operating the building. (See row 363 in the downloadable pfi current projects list march 2012 (.xls file).)

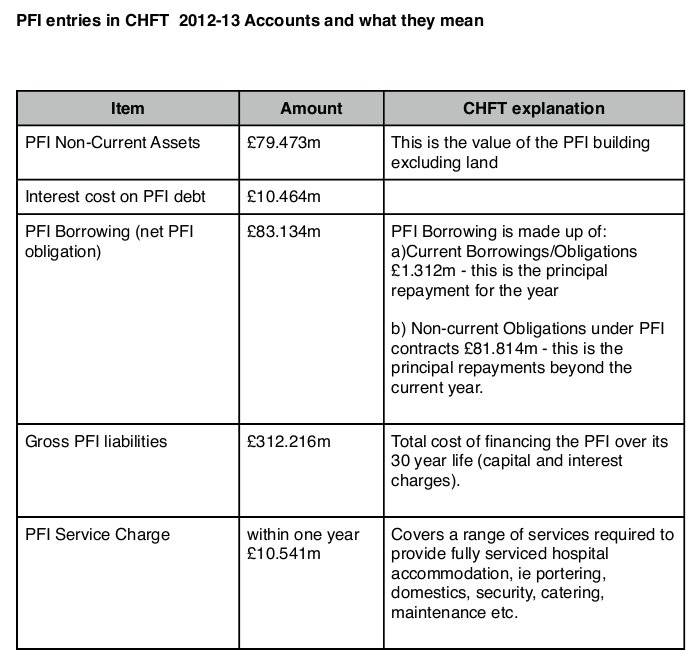

The Jubilee Debt Campaign calculates that over 30 years, CHFT has to pay £312 million to cover the PFI debt and interest costs. (The ‘mortgage’ payments bit of the Unitary Charge.)

If the money had been borrowed publicly, it would have cost an estimated £127 million. So the hospital will cost £185 million more than it should have done – enough for another one and a half hospitals.

All this for a building whose current net book value in the 2012/13 CHFT Accounts is £79.473m and which cost £64.6m to build.

CHFT won’t say if the PFI capital payment is higher than NHS England’s tariff allocation for capital costs in respect of Calderdale Royal Hospital

I asked CHFT whether the PFI capital payment was higher than the CHFT tariff allocation for capital costs in respect of CRH. (The tariff allocation for capital costs is the amount of money NHS England pays to cover the capital costs of buildings etc.)

Generally, PFI capital costs are higher than the NHS England tariff allocation for capital costs.

CHFT said,

“There is no direct correlation between the PFI capital payment and the tariff allocation. The tariff does not differentiate between NHS funded capital and PFI schemes. Tariffs are a complex area and are calculated on a national average of all provider/trust costs which take into account a range of factors.”

This doesn’t answer my question. I knew there isn’t a direct correlation, that’s why I asked what the difference is. Because if the PFI capital payment is higher than the amount that NHS England pays for capital costs of the CRH building, then CHFT is out of pocket and the difference has to come from somewhere.

I asked: if CHFT does have to make up a capital costs shortfall ( ie if the PFI capital payment was higher than the NHS England tariff allocation to CHFT for capital costs), whether this in any way endangered patient safety or reduced the Trust’s ability to provide optimal patient care.

The CHFT said that, as with all costs, the costs of PFI are factored into all areas of service delivery. Which again doesn’t answer my question.

Calderdale Royal Hospital PFI facts and figures

CHFT told Plain Speaker that the Calderdale Royal Hospital PFI contract is for 60 years with a break clause at 30 years, with early termination fees due at that point in time.

Craig Whittaker MP said that at a briefing with the Trust’s Chief Executive, he learned that the early termination fee would be £22m.

The break clause could be exercised in 2031 but before this decision is made, extensive detailed planning would be required to understand the implications both in service and financial terms. Craig Whittaker said that this would need to be done by 2029.

Although the contract is for 60 years, the repayment period for the PFI finance (capital and interest) is 30 years.

On the basis of the figures in this table, the annual PFI cost for 2012-13 was:

- Interest cost on PFI debt £10.464m

- Principal repayment £1.312m

- PFI Service Charge £10.541m

- Total £22.317m

I asked CHFT how the PFI Service Charge breaks down into the facilities management fee and the longer term maintenance fee, but CHFT said this info is commercially confidential.

There seem to be discrepancies between the Treasury PFI spreadsheet and CHFT accounts

When I added up all the annual Calderdale Royal Hospital PFI repayments listed in the Treasury PFI spreadsheet, up to and including 2012/13, this gives total repayments of £232.3m since the first year of repayment in 2001/2.

This leaves an outstanding balance of £430.9 to be repaid by 2031-32, the last year where a repayment is due.

This contrasts with £312.216m gross liabilities (row 4 in the table above).

In case this post provokes a fresh burst of party political sniping and blame gaming about which political party is responsible for the CRH PFI contract and debt, please note that CHFT started the process of entering into the PFI contract when the Tory Major government was in power and completed it when the New Labour Blair government had come in.

Updated 18 April with information from CHFT

Updated 10 Feb 2017 with info from Jubilee Debt Campaign.

Pingback: We must recognise the role of PFI debts in the NHS funding crisis - Jubilee Debt Campaign UK

Just a comment on the link to ‘PFI Projects in Procurement 2012’. The document that has the useful PFI data on CRH isn’t that one, but the ‘PFI Current Projects List March 2012’. Excel document, available on this page: http://webarchive.nationalarchives.gov.uk/20130129110402/http://www.hm-treasury.gov.uk/ppp_pfi_stats.htm

See line 363.

I note the £773m includes the ‘service’ charge (which makes up currently about 47% of the annual total)

Tx, the link in the Plain Speaker report is to the same spreadsheet as you can access through the webarchive link you’ve given. The Plain Speaker report link was faulty & I’ve fixed it now, thanks for noticing. The service charge is also exorbitant. And the PFI service contract has been sold on.

Thanks Jenny. Do you have any info on what the service charge covers, what the unit costs are etc ? I note Ben Gummer, speaking to the HoC debate the other day, based his ‘analysis’ on the service charge being 50% of the total (over the 30year term).

It covers stuff like hospital food, cleaning, laundry, maintenance,changing lightbulbs – everything that broadly comes under housekeeping and upkeep of the physical fabric of the hospital and the grounds. I think Ben Gummer’s statement about the relative cost of the PFI contract and the cost of building and operating the hospital with public funding and ownership is almost certainly wrong. He’s left a lot of stuff out and he also hasn’t mentioned that even at the end of the 60 years, under the terms of this particularly weird contract, the trust will still not have ownership of either the land or the building. So it isn’t really a mortgage, it’s like a ruinous tenancy agreement.

The CHFT accounts for 2012/13 say that the gross PFI liabilities – ie the cost of financing the PFI loan (capital and interest ) – over its 30 year life is £312.216m. That is on the basis of PFI borrowing of £83.134m. Then on top of gross PFI liabilities are the hugely inflated costs of the facilities management contract, which are way more costly than running the hospital facilities as part of the NHS would be. And then there is the fact that the bankers who extract profits from the PFI contract mostly don’t pay tax on them, and the cost of profit extraction and loss of tax revenue needs to be factored in. Just on the capital and interest costs, and leaving out all the other costs, my maths isn’t great and I’m not sure what the interest rate on public sector borrowing is but I’ve heard the figure of 4%/year floating around. And if I remember rightly, Interest = PRT/100. If these assumptions are right, the interest on a public sector loan would have been £102m. Meaning that the gross liabilities if you still had borrowing of £83.134m would be £187m not £312m. Meaning that for the £312m we could have had 1.7 hospitals.

I remember that very shortly after the election of the Labour Government, at Calderdale Hospital and Calderdale in general we all breathed a sigh of relief that the govt would continue with the PFT contract that had been through many years of negotiation with the Tory government and been actively campaigned for in Halifax for around 25 yearsfor. We all dreaded it being stopped dead in its tracks. Hindsight is always very clear.