New Century Care, which runs old people’s care homes across the UK, including five in Huddersfield, has just come under the control of Anchorage Capital Group, an American investment company based in New York.

Anchorage Capital borrowed £80m from Lloyds Bank to buy the controlling stake in the care home company. New Century Care Founder Paul Warren is keeping a significant stake in the company.

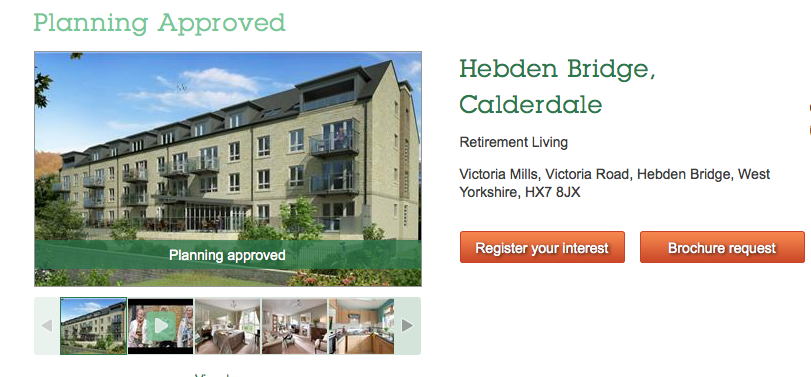

Anchorage Capital has also recently recapitalised retirement housing developer McCarthy and Stone, the company which is building retirement flats on the Victoria Road site in Hebden Bridge, where the engineering factory used to be.

Recapitalisation is a word that means nothing to me. But Investopedia says it means exchanging one form of financing for another.

In the case of McCarthy and Stone, finding a new source of financing was necessary because Lloyds, which had inherited the company after buying HBOS in 2008, wanted to get rid of its stake.

In 2012 McCarthy and Stone, which had £500 million of debt maturing in 2014, started looking at a number of options including flotation, refinancing and a trade sale.

This led to Anchorage Capital putting money into the company, in some shape or form, whatever form the recapitalisation took.

So taking care of old people is big business for the financial sector. Profiteering out of old age – what’s that about?

And the profits from retirement homes in Hebden Bridge and care homes in Huddersfield are flowing across the Atlantic to an investment company in New York.