Finn Jensen asks this question at the end of his post on Germany’s energy transition.

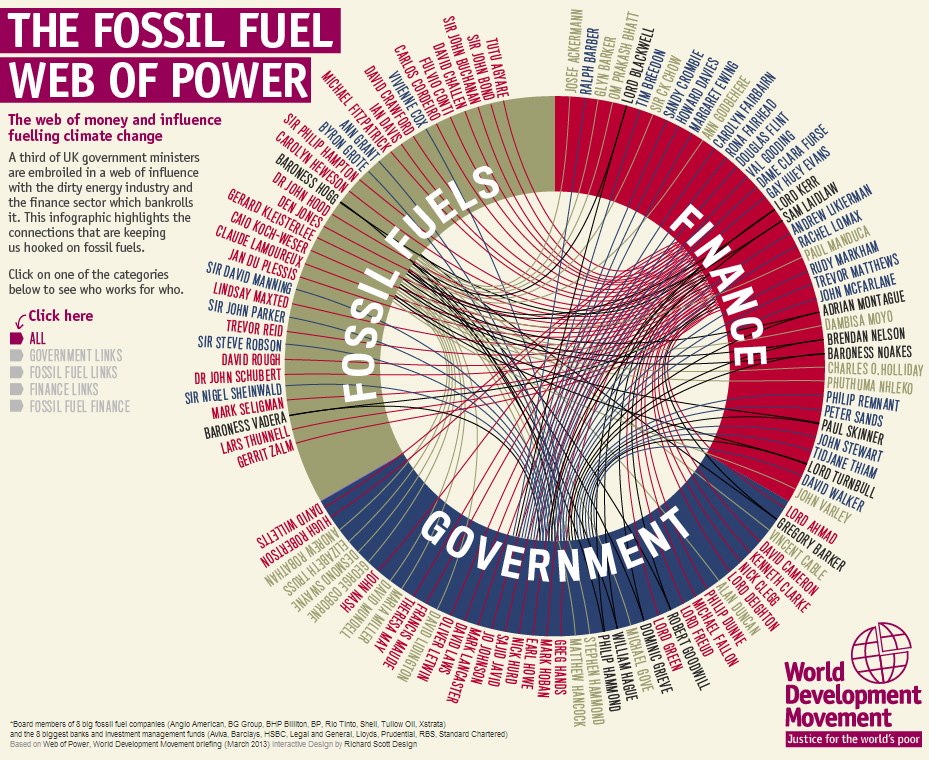

The answer may lie in the way that successive UK governments have allowed themselves to be captured by fossil fuel and nuclear companies.

This is the view of Sergio Oceransky, Director of the Yansa Community Interest Company. He thinks that the reason why UK has “the worst possible renewable energy regulatory framework…resulting in one of the lowest shares of green power in one of the countries with the largest renewable energy potential in Europe” is that nuclear and fossil fuel companies have captured UK governments’ energy policy process.

He notes that the UK government has also worked hard to extend its energy policies into the EU, with the result that the EU 20 20 20 climate change and energy policy package “is based on instruments that have proven totally unsuccessful in terms of promoting renewable energy and reducing greenhouse gas emisions, and that will displace existing successful policies and alternatives”.

Market for renewable energy certificates works against effective renewable energy policy

One of these instruments is the tradable renewable energy certificate, which is a key aspect of UK’s Renewables Obligation (RO) policy and, says Oceransky, is “incompatible with the only successful renewable energy policy (known as ‘feed-in tariffs’).”

The RO requires UK energy companies to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources, or pay a penalty.

Tradable renewable energy certificates are the means by which the Renewables Obligation (RO) operates. Ofgem issues Renewables Obligation Certificates (ROCs) to renewable energy generators when they invest in renewable energy generation, for every megawatt hour (MWh) of eligible renewable energy they generate.

Renewable energy generators can hold on to the ROCs for redemption by Ofgem, to meet its RO commitment. Or, if they have excess certificates, they may sell those ROCs on the market to other energy suppliers that wish to buy certificates to meet their RO commitments, because they’re not renewably generating the required proportion of the energy they supply.

Energy companies/suppliers then present Ofgem with ROCs to show they are complying with the Renewable Obligation. If they do not present enough ROCs, suppliers have to pay a penalty known as the buy-out price. The money collected by Ofgem in the buy-out fund is recycled to suppliers who presented ROCs. Ofgem’s payout is proportional to the amount of ROCs the suppliers redeemed in the previous period.

The ROC scheme is designed so that under-delivery of ROCs is the only way to trigger this subsidy. If the target number (or more) ROCs were presented, then the price would drop to zero. So effectively, the ROCs scheme encourages the under-production of renewable energy.

Another problem is that the buy-out or penalty price that Ofgem demands when there have not been enough ROCs for electricity suppliers to buy in order to meet their Renewables Obligation, is fixed and acts as a cap on the price of ROCs.

Various other problems with tradeable ROCs stop them from acting as an effective policy to support the growth of renewable energy generation. One of the problems is that independent power producers (IPPs) can’t participate in the ROCs market – they can’t get loans for the initial investment because of the uncertain price of the electricity they will generate. So Ofgem issues most ROCs to big energy companies, who then profit from the subsidies and retain their near-monopolistic dominance of the energy market, while making energy customers pay for their increased profits.

The results of the UK’s RO policy speak for themselves. The UK, with a much higher renewable energy potential than Germany, has installed far less renewable energy generation capacity than Germany, which has a renewable energy policy based on feed in tariffs.